Bearish Gold Risks Growing Ahead of US CPI

Gold Under Pressure

Gold prices are coming under fresh selling pressure today with the futures market turning lower again following a brief rebound off Wednesday’s lows. The market suffered a sharp decline across Tuesday and Wednesday as a softening of US/China trade tensions and a rally in USD combined to fuel a long-squeeze midweek. However, bulls have been unable to regain upside momentum with USD staying well supported through the week.

US/China Trade Talks

News that US and Chinese officials will meet in Malaysia today to resume trade talks has fuelled furtehr optimism that a deal can be agreed ahead of the upcoming Nov 10th deadline. If talks progress well today and we see positive headlines emerging over the weekend, this should weigh on gold prices further as safe-haven support weakens. Additionally, if we get any confirmation over the weekend that Trump and Xi will meet next week in Korea, this could see accelerated losses in gold as traders eye a stronger likelihood of a deal being agreed.

US Inflation Data on Watch

Traders will also be watching the latest US inflation data coming later today. Amidst the ongoing US govt shutdown this marks the first tier one release in weeks and could see plenty of cross-market volatility. If we see a fresh rise in PCI today, as expected, this should keep USD supported into the weekend, keeping gold prices skewed lower. Any upside surprise should amplify this dynamic. On the other hand, any downside surprise today could see gold rebounding as USD softens. However, the extent of any move in response to today’s data will be informed by the outcome of US/Chian trade talks which remain the bigger issue for now.

Technical Views

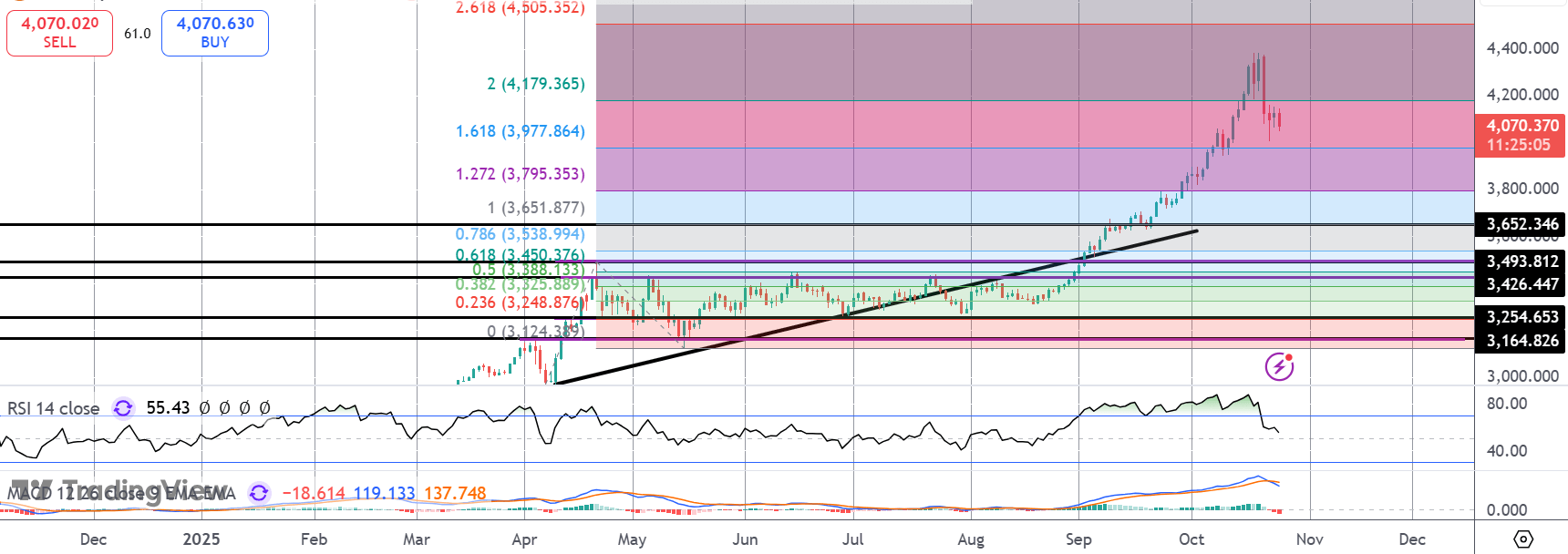

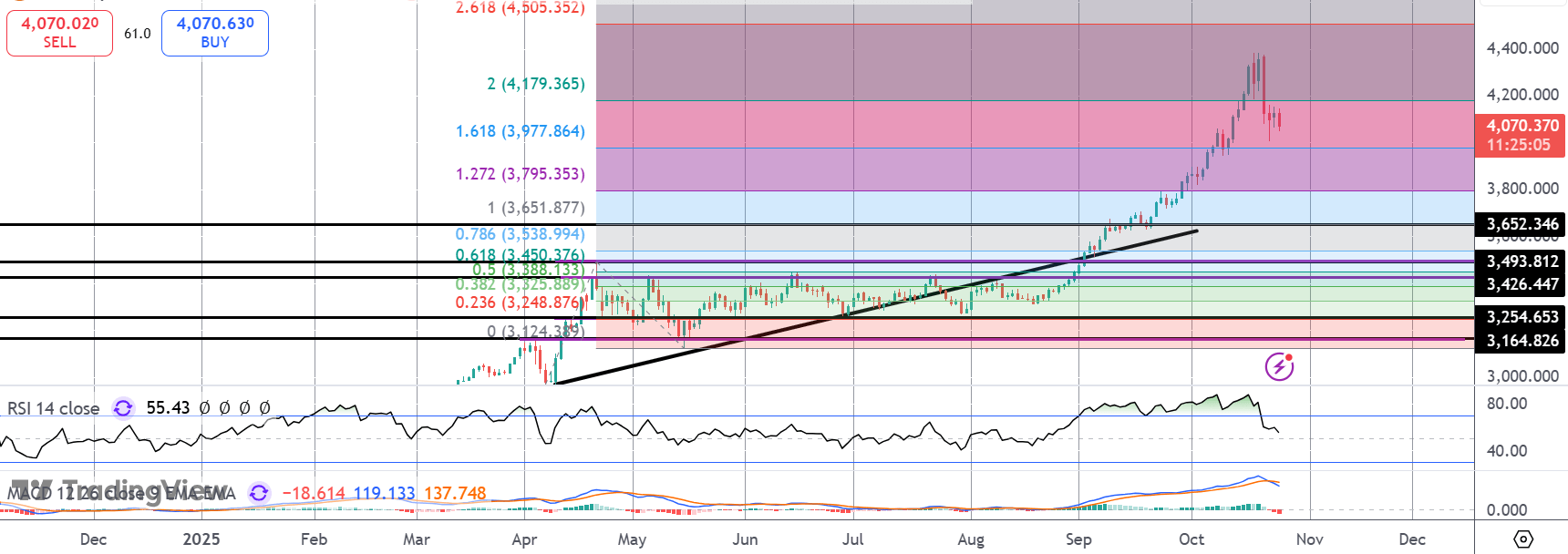

Gold

For now, gold prices remain atop the 1.61% Fib level at 3,977.86 following the correction lower from highs. Momentum studies are turning sharply bearish, however, suggesting risks of a deeper move. If we break lower here, the 1.27% level around 3,800 will be the next support to watch ahead.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.