Bitcoin: All-Time Highs Back In Sight

BTC Rally Growing

Bitcoin is on watch ahead of the weekend with the futures market soaring higher following a breakout move yesterday. BTC is now up around 11% on the week, trading $104k last, and is rapidly approaching a test of the all-time highs around the $108/$110k mark. The breakout move yesterday came in response to news of the trade deal between the US and UK. The deal marks the first trade agreement for the US since Trump imposed fresh tariffs across the board in April.

US/China Talks

Notably, the deal is being taken as an encouraging sign ahead of upcoming US/China talks due to start in Switzerland tomorrow. If we see positive headlines on the back of this weekend’s talks and it looks as though the two sides are moving towards a deal, BTC prices look poised to rally further with a breakout to fresh highs now the main objective for bulls.

Institutional Demand

The rally off the $75 lows has seen a growing tide of institutional money rejoining the market, propelling the move higher. BTC ETFs have seen 16 straight days of net-inflows with almost $150 million in long positions recorded yesterday. If talks go well this weekend, this dynamic is expected to continue and intensify, helping drive Bitcoin prices higher near-term. The only potential headwind for crypto traders is if talks breakdown this weekend and the two sides revert to a more hostile position.

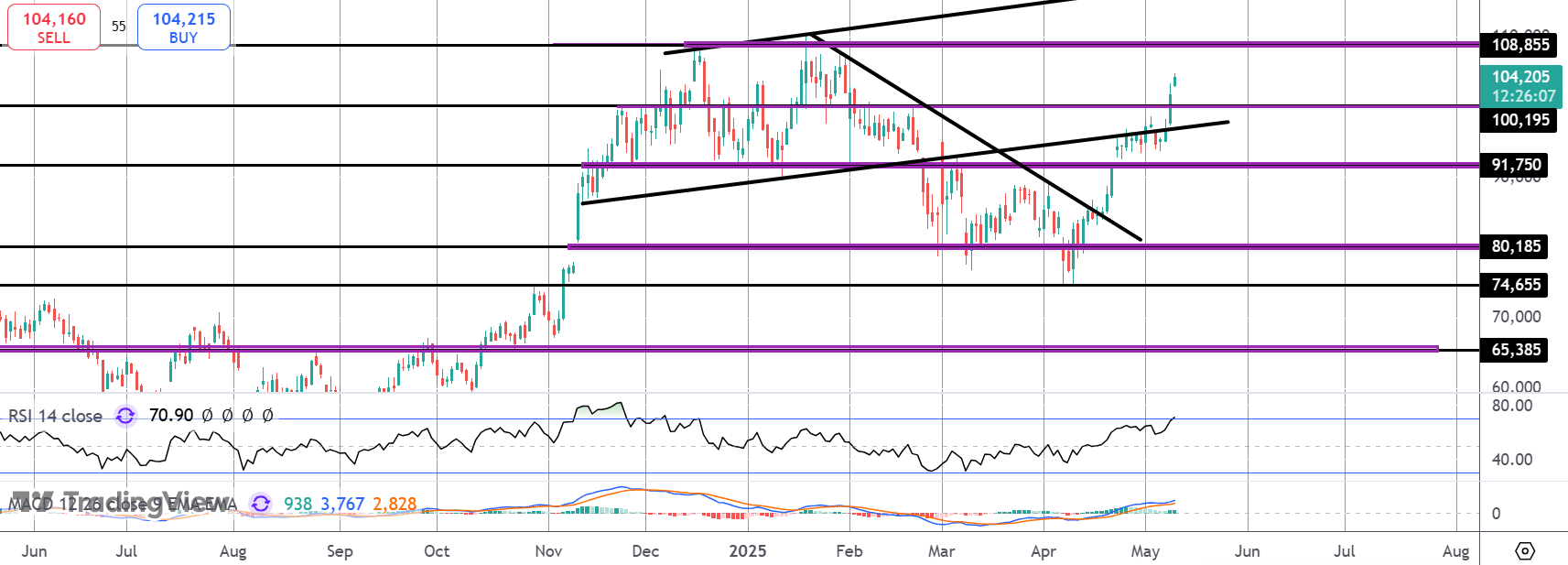

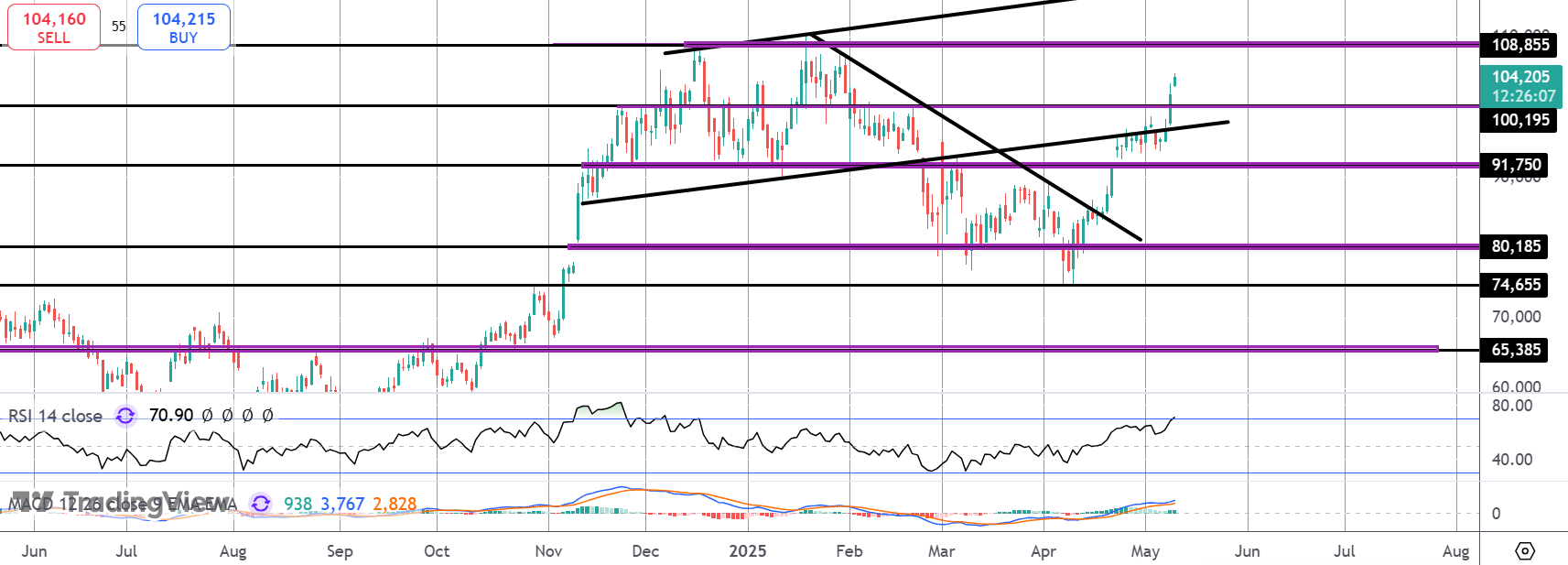

Technical Views

BTC

The rally in BTC has seen the market breaking back into the bull channel and above the $100k mark. With momentum studies bullish, focus is on a test of the highs around $108,85 next with bulls focused on a fresh breakout. This view remains intact while price holds above $100k.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.