Contested Elections Still Remain High Risk for Global Equities

While both candidates in the US elections early declare themselves winners, investors prefer to wait for the voting results. However, the true outcome could remain uncertain for several days due to postal voting and the resulting delays. Trump and Biden are going head-to-head, so it is possible that the losing candidate will disagree with the result, and the market will face a worse scenario - “contested elections”. Both candidates are already setting the stage for this in case of defeat.

The chances of full control of the Democrats have significantly decreased. Together with the risk of lawsuits it has increased risk aversion among some investors. The yield on 10-year US government bonds collapsed from 0.92% to 0.77% overnight:

Equity markets are relaxed, but cautious. European indices are hovering around the opening, futures for US indices have become noticeably depressed by the evening of America on Tuesday as it was increasingly clear that an easy victory for Biden would not happen and Trump was building up the gap. After soaring to 3430, the SPX futures dropped to 3350. As the candidates issue subtle hints that they may continue the struggle even after the announcement of the results, I do not think that the futures will trade steadily above 3400 points. I see the risk for more downside, but the necessary ingredient for this is the development in the story of contested elections. And I think there will be a development.

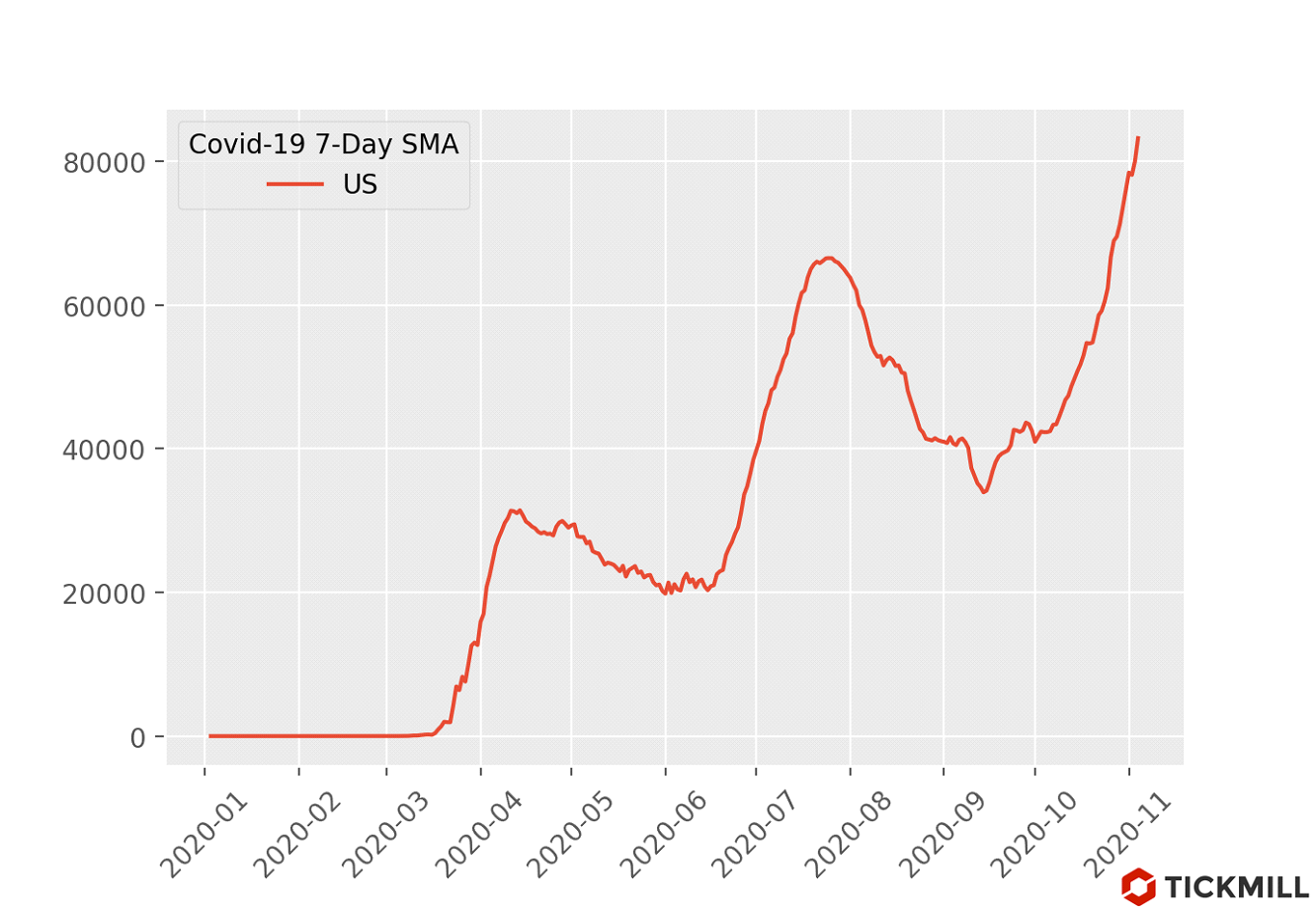

The virus is holding its grip over the US. In the near future this is a factor that should continue to stifle optimism (but still largely dormant):

Against this background I expect greenback index to regain edge especially if the risk with contested elections materializes.

Business sentiment indicators and Eurozone business climate metrics beat expectations, but they don’t take into account the lockdowns, so the impact on European markets is minimal. The US economic calendar will not be particularly relevant this week (even the Fed meeting and the NFP report), however, when the dust settles, the analysis of the economic momentum in the US will again come to the fore. Therefore, we are closely watching the ISM indices, trade balance and ADP report, which will appear later today.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.