Fed Meeting Review: Hard time for Powell to Explain Fed Decisions

As I wrote in the article “Preview of the Fed Meeting: Hard Data vs. Soft data Puzzle for the Fed”, strong US economic data throughout July left the contour of risks quite blurred for the Fed. They were mainly comprised of the risks in foreign trade, and to a lesser extent of the risks of inflationary expectations drifting away from the Fed's benchmarks, becoming difficult to control (“deanchoring inflation expectations”).

However, the factor of “resistant inflation” is now explained by long-term structural changes - population aging, disruptive technologies (amazon, uber) depriving firms of market power, a decrease in the negotiating power of workers with a rising share of unskilled workers in total employment (and, as a result, dead Phillips curve)

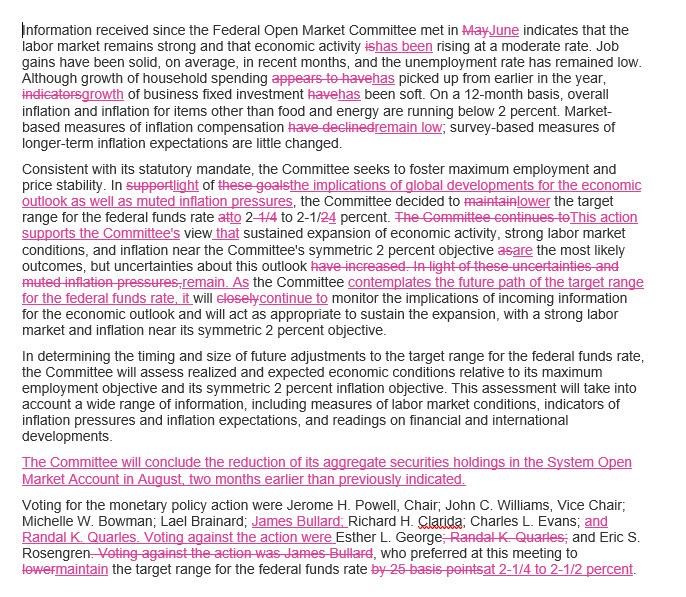

As a result, the July rate cut was primarily a reaction to alarming economic changes abroad, which was stated directly in the FOMC statement:

“In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower ...”

Powell described the rate cut as a “mid-cycle adjustment”, not only effectively debunking the market hypothesis about the start of new easing cycle, but also hinting that aggressive easing is logically inappropriate at the current stage of expansion. On the one hand, in support of this, Powell made the following statement at the press conference:

“This isn’t the start of a long series of rate cuts”

But answering another question, he already denied himself:

“I didn’t say it’s just one rate cut” (“I didn’t say that subsequent rate cuts are impossible”).

However, in the case of the second phrase, Powell explicitly referred to the “rule” that subsequent decisions would depend on incoming economic data.

If you combine these two phrases into one, it will result in "We are not starting a policy easing cycle, but we will act as appropriate."

A surprise was also the decision of Eric Rosengren, the head of the Federal Reserve Bank of Boston and the traditional centrist, to “join the opposition” by voting to keep the rate at the same level. Thus, two out of ten officials, Rosengren and George, took a hawkish position, and with such a split it is much more difficult to expect a consistent reduction in rates, which greatly pleased the bulls in the dollar.

The odds of interest rate staying at the range of 175-200 bp in September decreased to 51.9% compared to 59.1% a week earlier.

And here is updated Fed statement:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.