Follow The Flow: NZDCAD Testing Channel Lows

Kiwi Coming Off

The New Zealand Dollar has come under heavy selling pressure on Tuesday, despite a broad pickup in risk appetite. The latest data released overnight showed the New Zealand trade surplus narrowing sharply from the prior month, reflecting the negative impact of recent weather emergencies there. Recent cyclones and flooding saw the RBNZ opting for a smaller hike at the latest meeting along with forecasts of a slower pace of tightening over the year ahead. Additionally, the rebound in risk appetite on Tuesday appears to be favouring EUR and GBP over NZD and AUD which are both struggling as we approach the middle of the week.

CAD Lifted

CAD has emerged as one of the better performers in the G10 FX space on Tuesday. Expectations of a less hawkish March FOMC tomorrow are helping lift sentiment. Additionally, CAD Is being buffered by a rebound in crude prices which have picked up sharply today following a soft start to the week. The retail community is holding a large 81% long position in the pair suggesting plenty of room for NZDCAD to continue lower near-term. CAD CPI today will be the key event to watch which any signs of a pickup likely to drive CAD higher near-term.

Technical Views

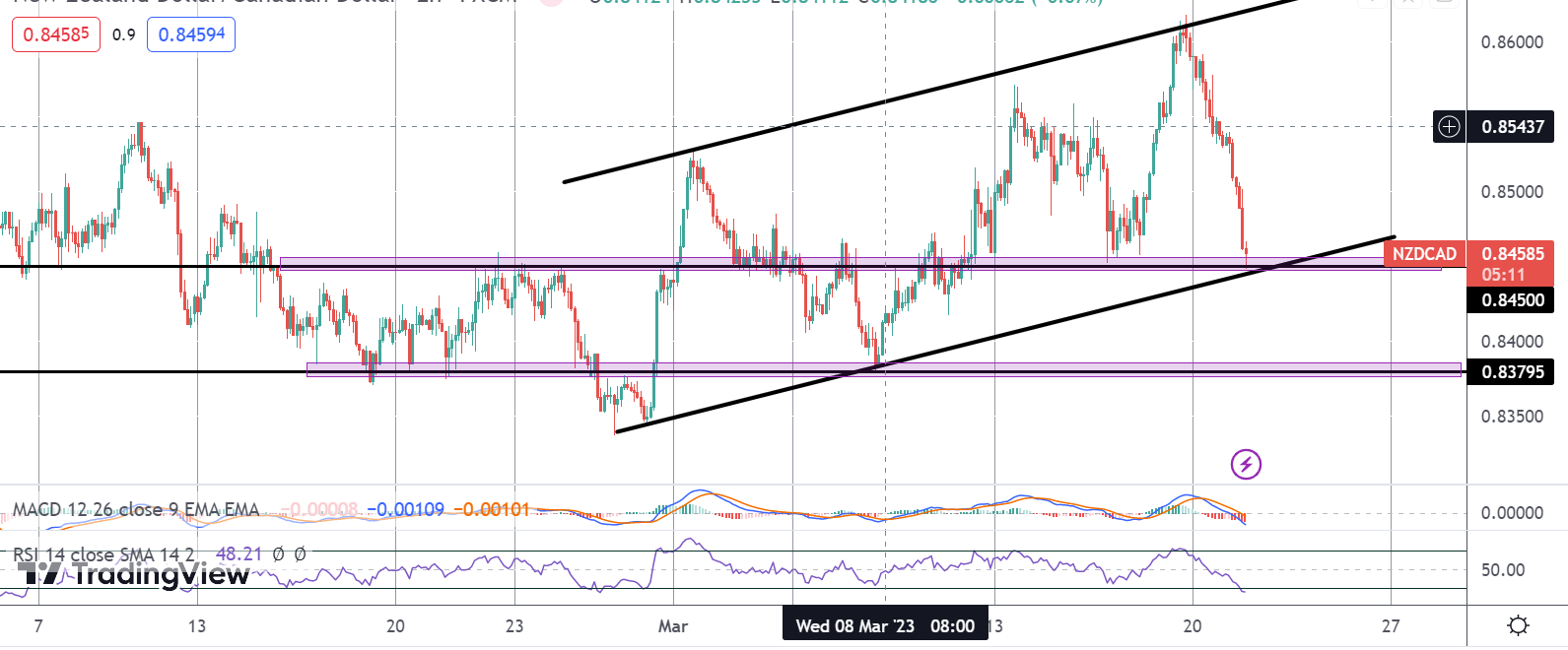

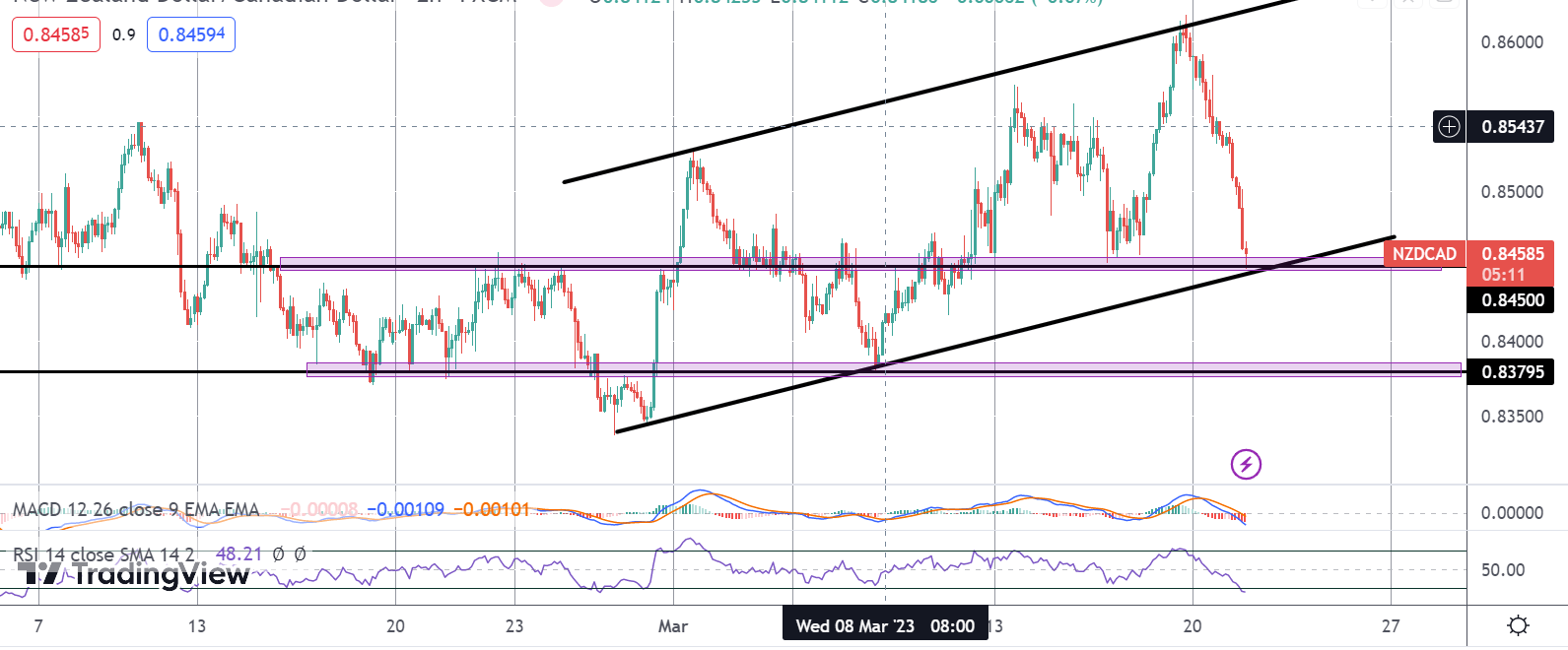

NZDCAD

Following the reversal higher from the latest test of the bull channel highs, price has since reversed sharply lower. The pair is now testing the channel lows and structural support at the .8450 level. This is a key level for the pair and a break here will be firmly bearish opening the way for a test of the .8379 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.