Gold Sinking Ahead of Trump/Xi Meeting

Trade Deal Optimism Growing

Gold prices continue to plunge lower through early European trading on Tuesday. The futures market is now more than 5% on the week and more than 11% from the YTD highs printed earlier this month. As optimism continues to build ahead of Thursday’s scheduled meeting between Trump and Xi, gold prices look likely to remain pressured lower this week. Talks over the weekend between US and Chinese delegates resulted in the establishment of a framework for a trade deal which is expected to be signed off by the two leaders this week, extending the current tariff pause beyond the Nov 10th deadline. If Trump and Xi agree a deal on Thursday this should see gold prices moving sharply lower near-term as risk assets continue to gain ground. Only a surprise breakdown in relations and failure to agree a deal is likely to see gold prices finding any real demand at this point.

FOMC On Wednesday

Ahead of Thursday’s meeting, traders will be watching the Fed on Wednesday. The FOMC should have the potential to lift gold prices, given the broad dovish expectations we’re seeing. However, a rate cut this month has been priced in for weeks now and with the US/China trade story becoming the bigger issue, the FOMC is likely to be overshadowed this week unless we get any fireworks such as a larger than expected cut from the Fed or aggressively dovish guidance. In that scenario, USD should see some selling with gold rallying. However, the trade story is likely to remain the bigger issue, keeping upside prospects limited for gold near-term.

Technical Views

Gold

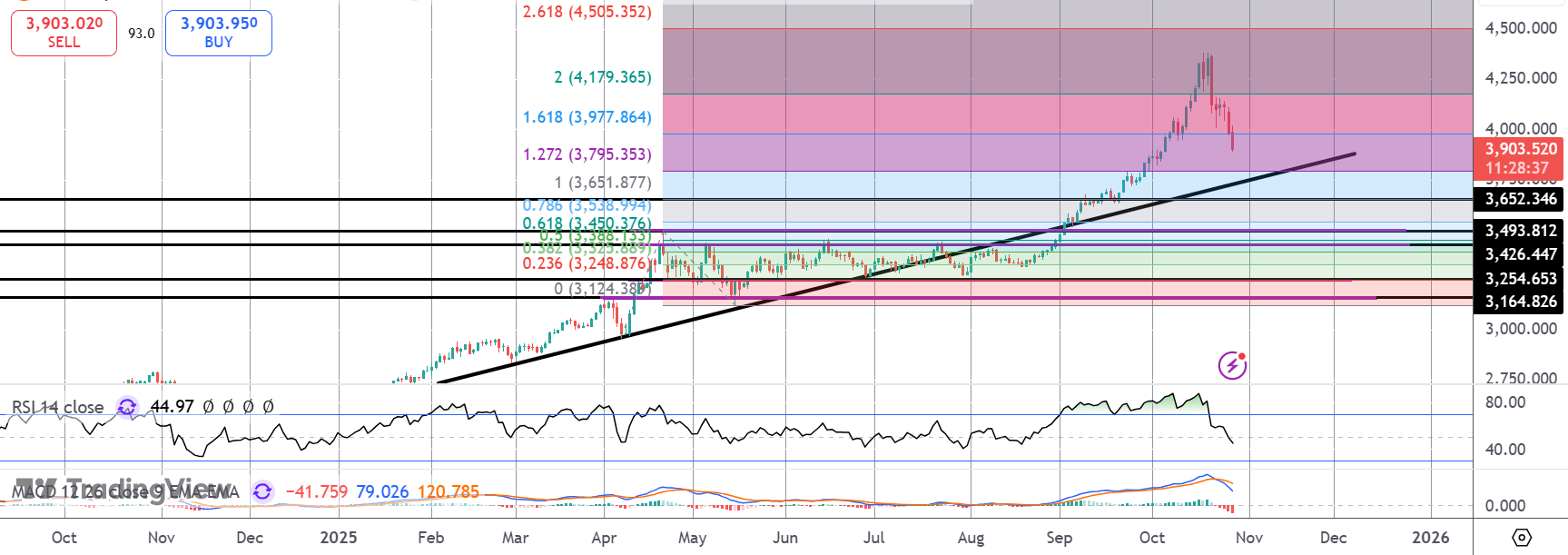

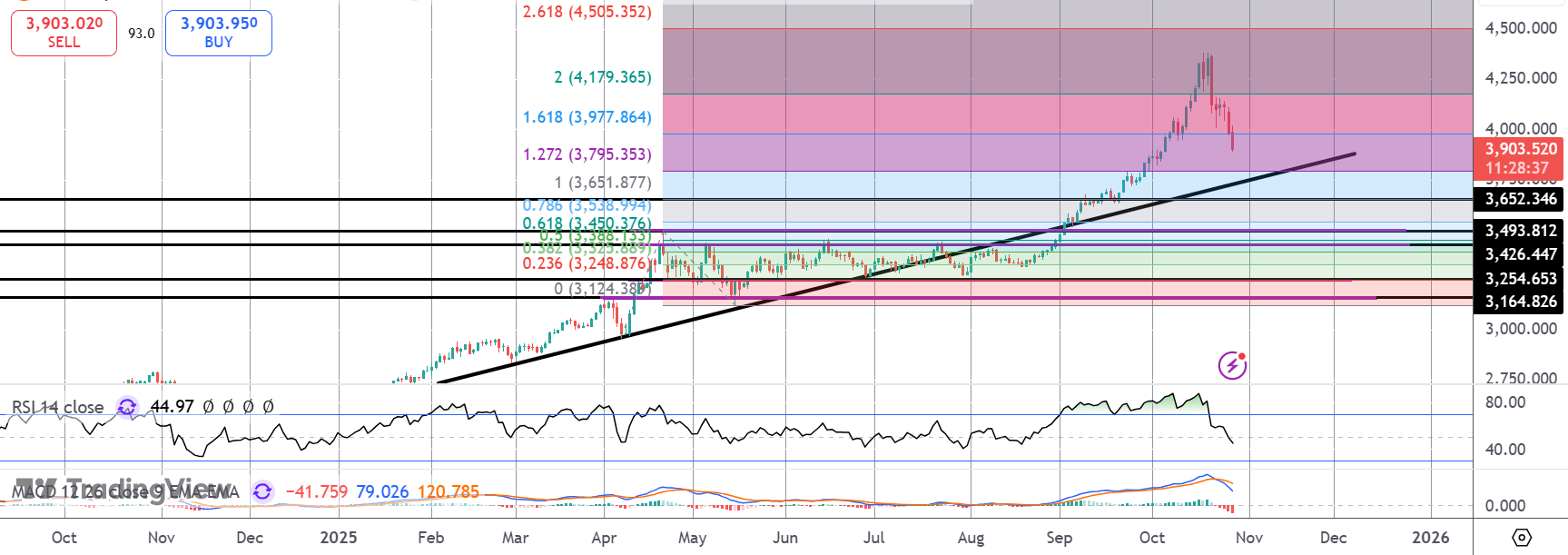

The sell off has seen the market breaking back down below the 1.61% Fib level with the 1.27% level at 3,795.35 the next objective. With momentum studies bearish, focus is on a continued push lower with a retest of the Q2 2025 highs around 3,450.37 a growing possibility now. Ahead of that level, the bull trend line might offer some support, coming in around the 3,651.85 1% Fib level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.