Institutional insights: BofA - Liquid Insight: EUR in a less USD world

.jpeg)

BofA - Liquid Insight: EUR in a less USD world

Key Takeaways:

• EUR's transformation from zero to hero: US reciprocal tariffs are detrimental to Europe, but even more damaging to the US. Germany's fiscal shift is a significant game-changer.

• Upside risks to our already optimistic forecasts stem from the EU's measured response, new trade deals with the rest of the world, EU reforms, and increased fiscal measures.

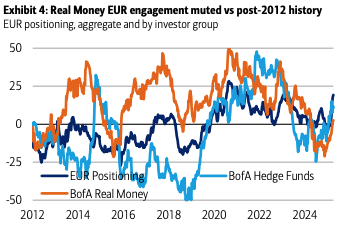

• Real Money remains a crucial group to monitor. The EUR stands to gain from ongoing shifts towards Europe and higher USD hedge ratios.

Shifting Goalposts

The sentiment towards the euro (EUR) has significantly improved since the beginning of the year. While US reciprocal tariffs could impact Europe, they are likely to affect the US even more. We anticipate potential upside risks for the EUR due to a measured EU response, ongoing EU reforms, and efforts to establish trade deals globally. Following Germany's fiscal policy shift, we foresee further upside risks to our already optimistic EUR forecasts, predicting EUR-USD at 1.15 this year and 1.20 next year, driven by potential additional joint EU issuance later this year.

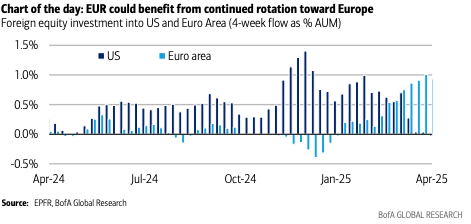

On the flow side, the EUR could benefit substantially from continued asset reallocation toward Europe and increased hedging ratios by European asset managers. Our data indicates that Real Money engagement has been relatively modest compared to post-2012 levels, while Officials continue to rebalance. Sanity checks suggest the EUR has outperformed. We maintain a bearish stance against GBP and "high beta" currencies but remain bullish against USD, JPY, and CHF, believing the EUR's goalposts are just beginning to shift.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!