Institutional Insights: TS Lombard - Has The Dollar Peaked?

TS Lombard: HAS THE DOLLAR PEAKED?

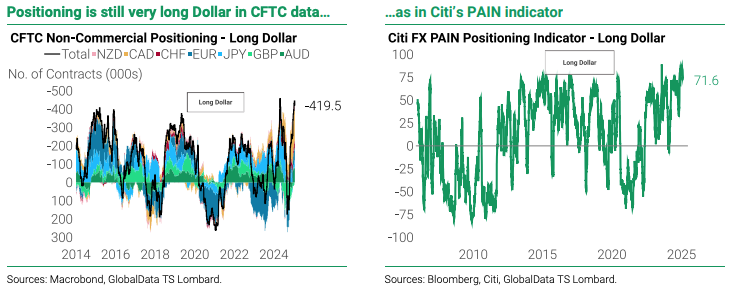

The looming threat of tariffs implies that US trading partners may be open to negotiating concessions, a scenario that could weaken the dollar given the current position bias. The ongoing strengthening of the US labor market empowers the Federal Open Market Committee (FOMC) to uphold its stance of being "well above neutral," thus pointing towards a potentially dovish stance.

Despite potential dollar bearishness, the combination of high yield and "trade war convexity" continues to position the long dollar as a key carry trade choice. The strategy of "America First" policies, involving tariff threats as negotiation tools for concessions, has started to impact the long dollar trade due to extensive positioning. This trend has facilitated a shift away from US assets, triggered in part by recent developments like the DeepSeek scare.

While renewed tariff threats from the Trump administration have supported the dollar's recovery from last week's losses, the White House's strategic use of tariffs for negotiation leverage with key trade partners may sustain the dollar's appeal as a top carry trade choice. Trump's demonstrated credibility with these threats, as evident in the Colombian incident, underpins the prime position of the long dollar trade, especially given the potential for broader trade escalations and the inherent convexity in such situations.

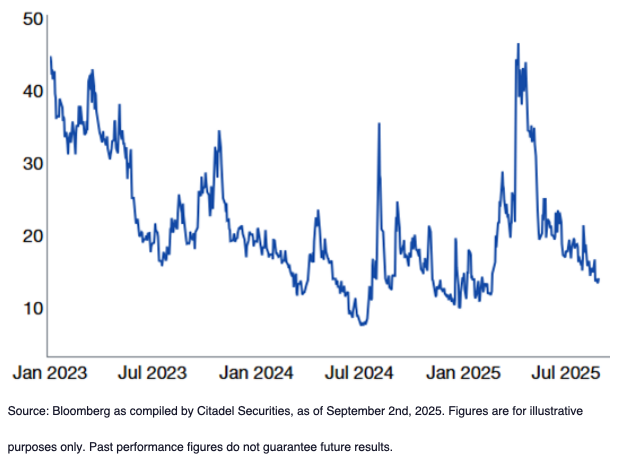

Tariffs, in essence, are not inherently inflationary but rather cause a one-time adjustment in the price level. However, they could introduce complexities for the Federal Reserve's policy considerations this year. The decision to uphold a long DXY position, initiated in August when the bottom in the dollar was forecasted, reflects a strategic stance maintained by the investors in response to evolving market dynamics and potential implications of tariff-related challenges on the dollar's performance.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!