Italian Parliament To Scheule Vote of No Confidence

Coalition Divided

Rising tensions within the Italian ruling coalition has now resulted in the Lega's leader, Matteo Salvini, calling for new elections. Consequently, the head of the upper house of the Italian parliament has re-summoned the house from recess today, for the Italian parliament to Schedule vote of no confidence on the Italian Prime Minister.

Vote of No Confidence

The vote of no confidence will be the first step towards a possible new Italian government, or fresh elections. According to the press, in yesterday's meeting with the head of the upper house, parties were divided between those which wanted to hold the no confidence vote on August 14, (including la Lega) and those which wanted to postpone it until the latest possible date, 20 August (no confidence motions have to be discussed within 10 days).

Possible Scenarios

Recent events suggest that it's unlikely that the Italian government will survive the vote. Having called the vote, Lega will almost certainly vote against its own government, and market watchers see little reason why opposition parties might come to its rescue. So, in all likelihood, next week will mark the end of the Lega-Five Star Movement coalition government.

Elections or Technocratic Government?

It is currently difficult to determine whether Italy will end up having fresh elections or a technocratic government in place at least until the beginning of next year. Italian president Sergio Mattarella faces a difficult decision. On the one hand, he might be cautious on elections without a budget in place. On the other, the current parliament composition is at odds with the polls and impending elections could be unpopular with voters. For that reason, elections in October is a slightly more likely outcome, but it's still a close call, especially if there will be further delays in the no confidence vote. Markets expect more clarity in the next few days, or coming weeks at the latest.

Market Impact

From a market perspective, a technocratic government might be preferred at least in the near term. Markets tend to dislike the uncertainty brought about by an election, and the related market volatility. Furthermore, traders might be wary of the risks associated with a far-right euro-sceptic party such as Lega gaining an absolute majority of seats. However, if elections are avoided now, a technocratic government might not last long in any case.

Balance of Risks

The balance of risks for the EUR and Italian bonds appears tilted to the downside moving ahead. Over the weekend, former prime minister Matteo Renzi (of the Democratic Party) showed interest in forming a coalition with the Five Star to deliver the 2020 budget and avert a VAT tax hike. This option, which may provide some short-term respite to market concerns, has been staunchly opposed by the current Democratic leader (Nicola Zingaretti) and a large part of Democratic MPs. However, Renzi still has a number of followers in the parliament and may ultimately have enough seats to govern with Five Stars. It would remain to be seen whether Five Stars would accept the deal.

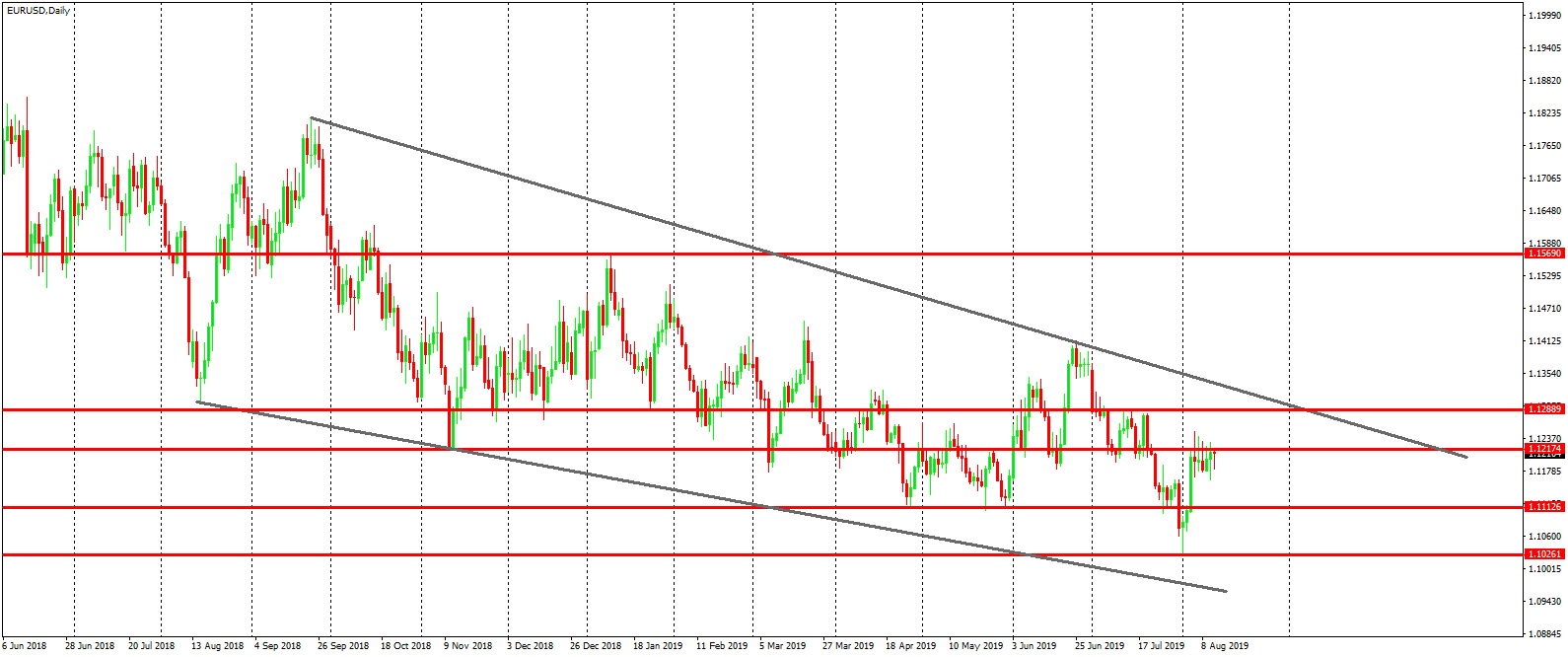

Technical Perspective

EURUSD continues to trade within the middle of the bearish channel which has framed price action over the year so far. Expectations of further ECB easing are keeping sentiment skewed to the downside for now. As such, a negative reaction to political developments in Italy could see a sharp movement back down to the 1.1026 base, with the bear channel low, just beneath. On the other hand, a positive market reaction to the outcome of today’s vote could see a spike higher into the 1.1288 region where we also have the bear channel top. However, given the negative outlook for EUR any rally is likely to be met with sellers at higher levels.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.