New All-Time Highs in Gold

Gold Breaks Out

Gold prices have broken out to fresh record highs this week with the futures market soaring to 3,694.75, as of writing. The move comes amidst fresh weakness in the US Dollar has the greenback heads south ahead of tomorrow’s keenly awaited September FOMC meeting. The Fed is widely expected to cut rates by .25% while signalling that further easing is expected over the remainder of the year. Recently, traders Fed expectations have turned increasingly dovish, fuelled by growing weakness in labour market data. Even a fresh rise in US CPI last week didn’t dent easing forecasts with the market currently pegging three .25% rate cuts before year end, starting this week. Indeed, some players are even looking for the Fed to kick things off with a bigger cut this week with the CME showing around a 5% chance of a.5% cut tomorrow.

US Retail Sales Due

Looking ahead today, traders will be watching the latest US retail sales data. Given that this will be the latest tier one US release ahead of the FOMC gold bulls will be hoping for fresh weakness to help fuel further USD selling/gold buying. On the numbers front, the market is calling for the core reading to rise to 0.4% from 0.3% prior with headline to fall to 0.2% from 0.5% prior. In line readings or an upside surprise should have little impact today though any downside surprise should elevate dovish expectations into the Fed, lifting gold further.

Technical Views

Gold

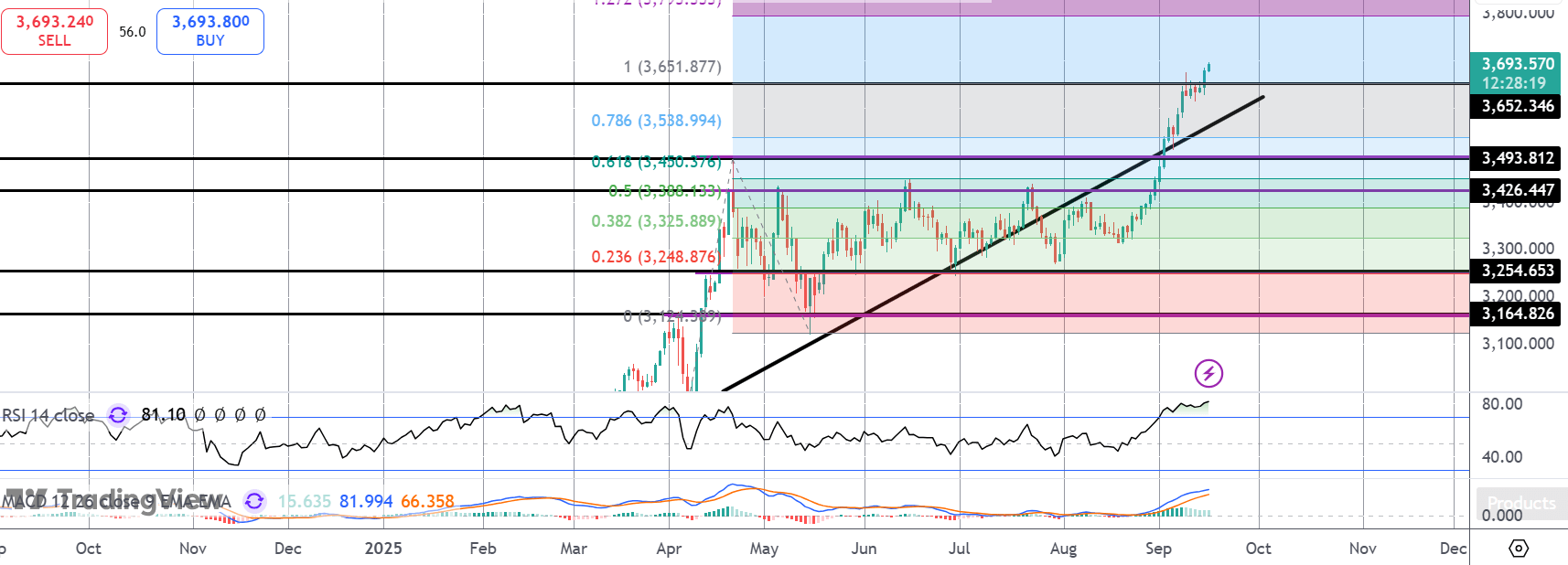

The rally in gold has seen the market breaking out above the 1:1 Fib extension at 3,652.34 with focus now on a continuation towards the 3,800 level, in line with bullish momentum studies readings. Outlook remains bullish while 3,493.81 holds as support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.