USDJPY Rallying On Dovish BOJ

Yen Falls Following BOJ Meeting

USDJPY is rallying today on the back of a more dovish tone from the BOJ overnight. The bank held rates unchanged, as expected, but struck a far-less-hawkish tone than many were expecting. Governor Ueda warned of the economic risks linked to the ongoing US trade war, which mean that the outlook is less reliable than before. The bank now expects inflation and wage pressures to cool in coming months, creating a delay in meeting the BOJ’s 2% CPI target.

BOJ to Remain Flexible

In light of these risks, Ueda warned that the BOJ would need to be flexible with its policy actions. If tariffs are reversed, Ueda said the bank has room to raise rates quickly but while these risks remain there is no need to pursue a faster pace of tightening.

US Data Next

JPY has fallen sharply on the back of the meeting with traders scaling back their near-term BOJ hiking expectations accordingly. Looking ahead, focus is now on upcoming US data tomorrow with the latest labour market reports due. If we see any upside surprise in the data sets this could fuel a sharper recovery in USDJPY near-term.

Technical Views

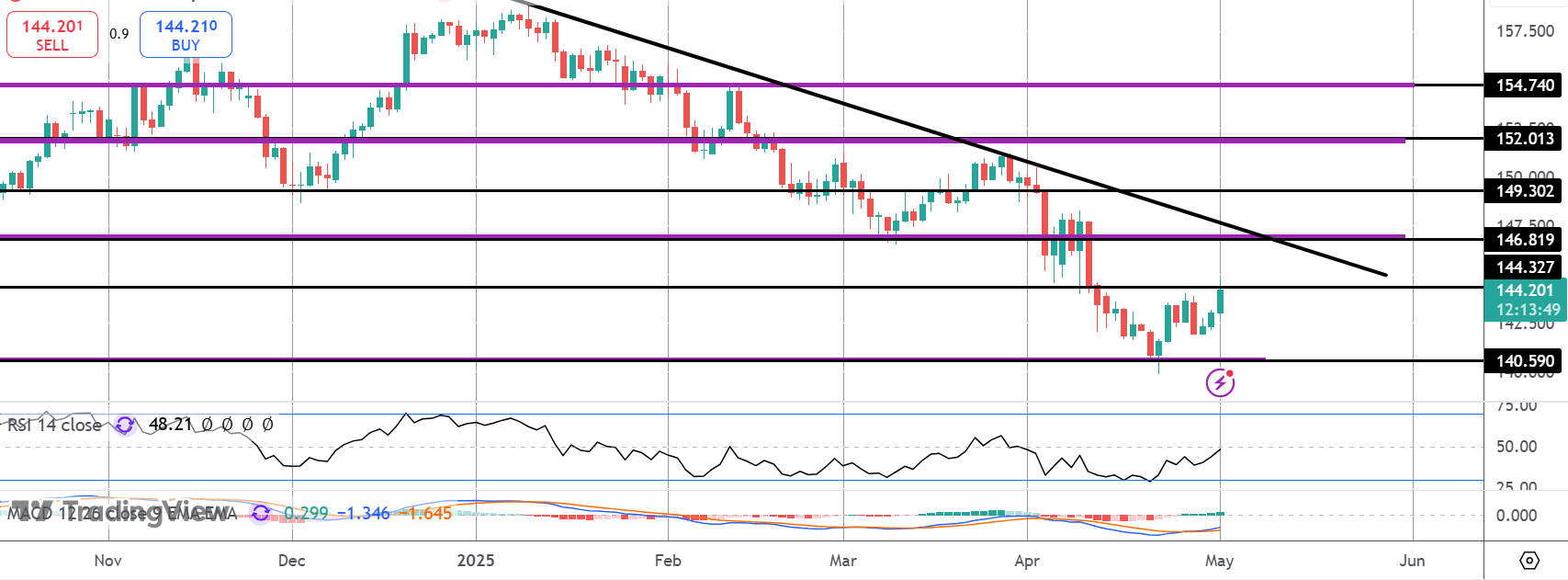

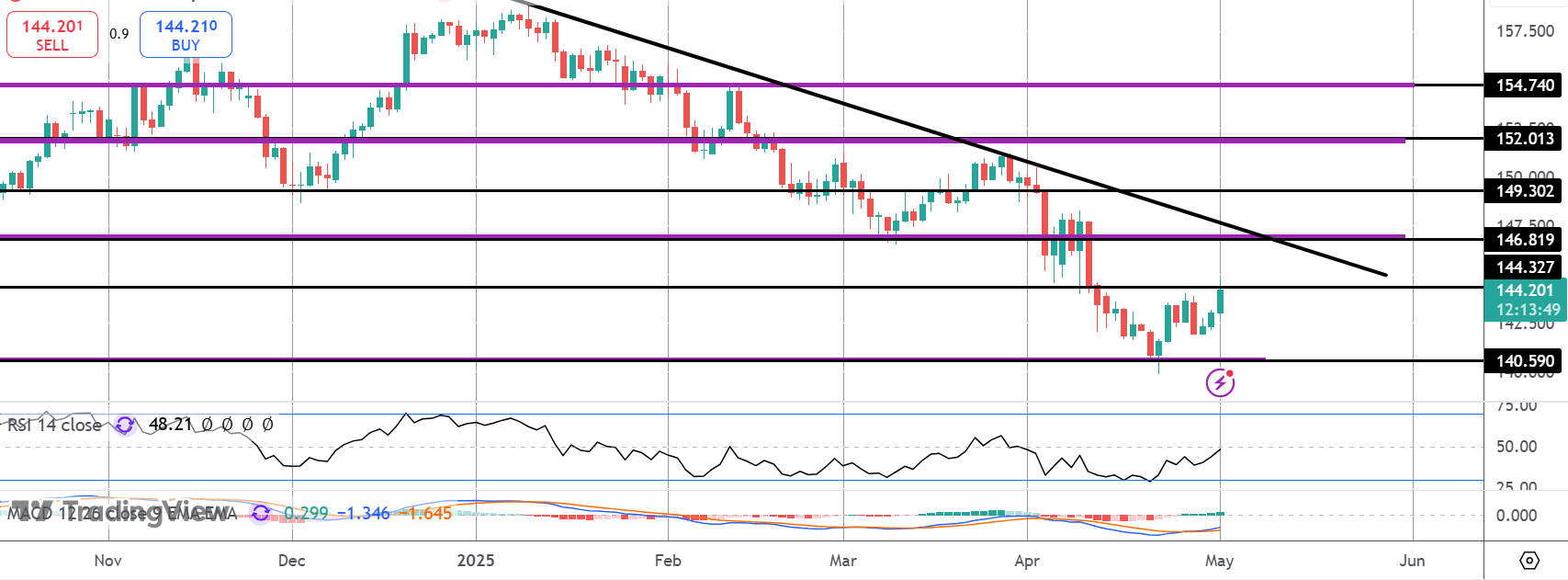

USDJPY

The sell off in USDJPY has stalled for now with price rebounding off the 140.59 lows. Market is currently testing 144.32 resistance ahead of the more important hurdle at 146.81 where we have the bear trend line also. Bears need to defend that level to maintain the bearish trend.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.