What to Watch in Copper

Copper Holds at Support

Following a heavy sell off across the first half of the month, copper prices have stagnated over recent weeks with the futures market trading a tight range atop the 4.30 level. The key drivers of downside sentiment have been weakness in China data, disappointment with government stimulus, a stronger US Dollar on increased risks of a Trump elections win and a less dovish outlook from the Fed, as well as weaker manufacturing levels globally. Despite generally gloomier conditions, the market has been able to stabilise and avoid a further sell off.

Bearish Copper View

However, there are big risks ahead with tomorrow’s US jobs report and the US elections to follow next week. The most bearish scenario for copper would be a strong upside surprise tomorrow, leading USD higher on a scaling back of dovish Fed expectations beyond the November FOMC. Additionally, should Trump succeed next week, a return to protectionist trade policy is expected to further boost USD near-term, weighing on commodities sentiment, a double blow for copper.

Bullish Copper View

On the other hand, if we see some weakness in tomorrow’s US labour market data, this should bolster December easing expectations, leading USD lower. If Trump then loses next week, USD is likely to be sharply unwound as ‘Trump trade’ speculation evaporates from the market. Finally, the prospect of fresh China stimulus could also help revive copper buying. This week, Chinese manufacturing was seen returning to positive territory for the first time in six months, in an encouraging sign for demand there. This sentiment could increase if China announces fresh stimulus in the near-term.

Technical Views

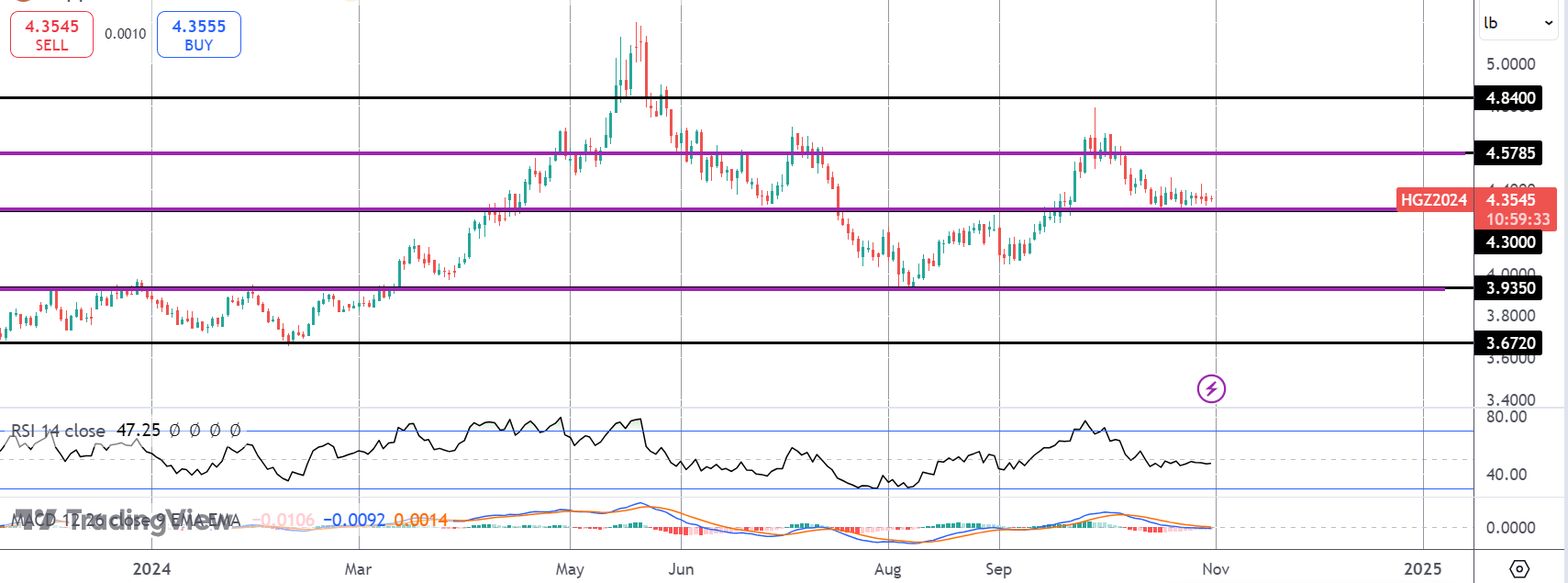

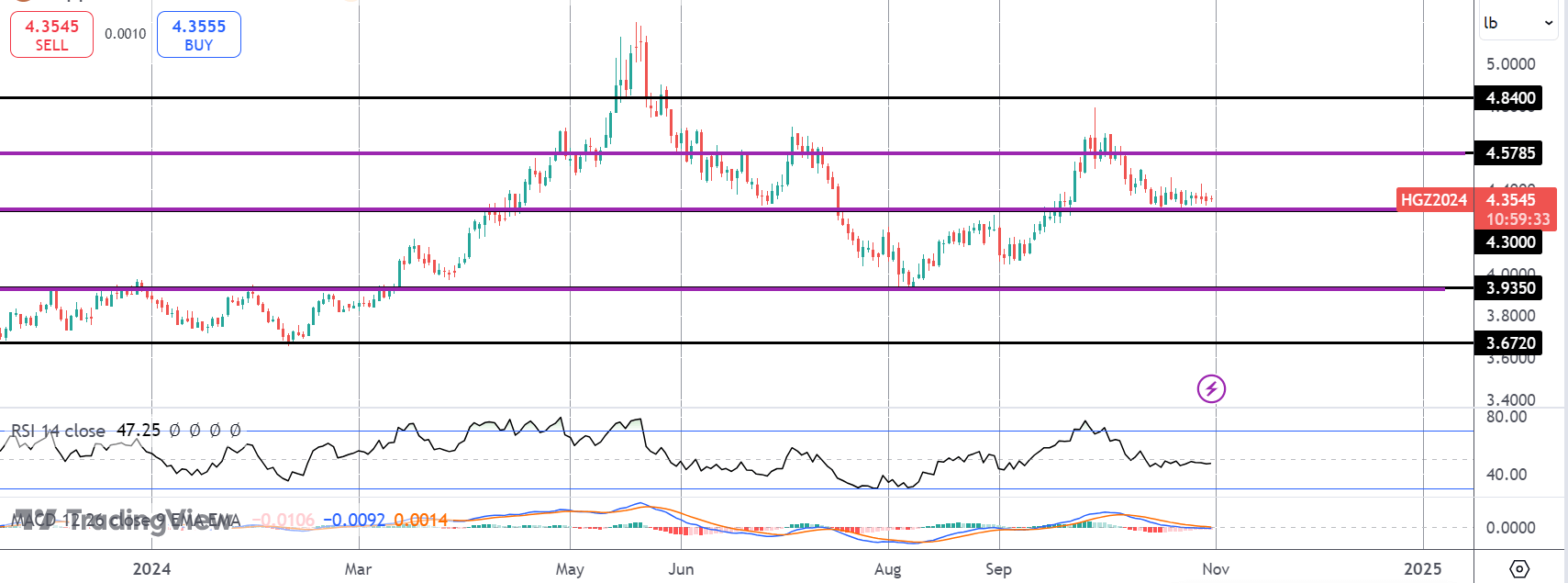

Copper

The sell off in copper has stalled for now into support at the 4.30 level. With momentum studies flattened, direction risks are even both sides. If we break lower, 3.935 is the next support to note while a rally above 4.5785 will put focus back on 4.84 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.